There’s Never a Good Time for a Breakdown

No time is a good time for something in your home to unexpectedly break. But it seems like home systems and appliances always fail at the worst possible time. Record-setting heat wave? That’ll be the week your air conditioner dies. Having everyone over for Thanksgiving? That’ll be the day your sink gets clogged or your garbage disposal kicks in.

A Home Warranty Helps Protect Your Budget and Your Home

One of the most frustrating things about dealing with an unexpected breakdown is the fact that it can deplete your emergency fund or force you to rearrange your budget to accommodate the cost of repairs. That’s where a home warranty can be a huge help.

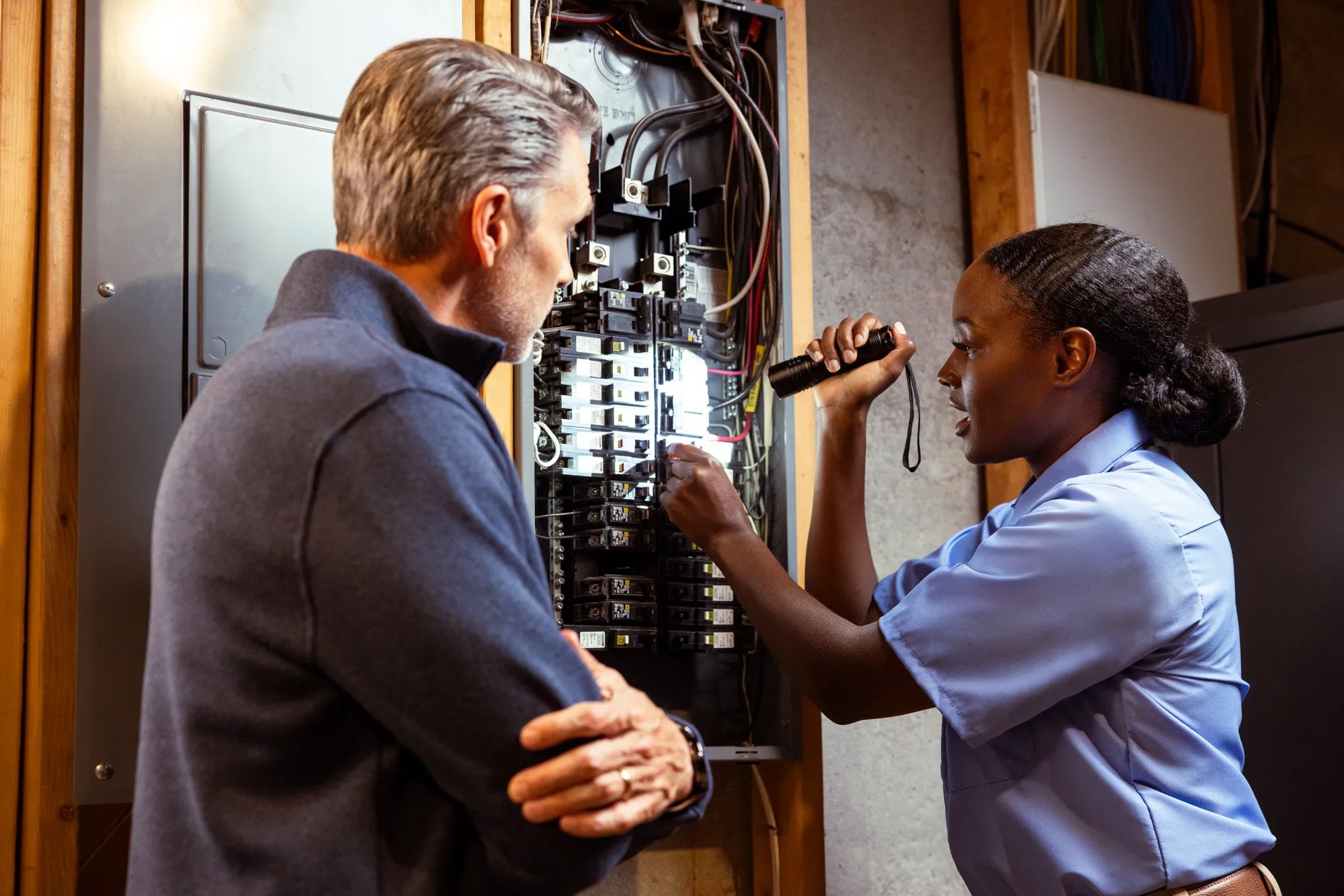

What does a home warranty cover? Coverage can vary widely from one provider to the next. At American Home Shield, we offer coverage for components of up to 21 of your home’s systems and appliances. Systems we cover include heating and ductwork, air conditioners, electrical, doorbells and chimes, plumbing, water heaters, central vacuums, ceiling fans, and smoke detectors. Appliances we cover include refrigerators, ranges, clothes washers and dryers, built-in microwaves, trash compactors, dishwashers, built-in food centers, and freestanding ice makers. Now, we also offer our customers optional electronics warranty coverage for TVs, laptops, tablets, and more.

You can choose to cover just your appliances, your home systems, or, for the best value, you can cover both with our combo plan. We cover items no matter the age, and we don’t require maintenance records.

Having a home warranty makes it easy to plan for repairs to be done if something does break down in your home. When a covered home system or appliance breaks down, simply place a call to American Home Shield, and we’ll send one of our professional network contractors out to your home. You’ll pay a Trade Service Call Fee when you request service, rather than paying the full retail cost of the replacement or repair. Plus, you can request service by phone or online, 24 hours a day.

Having a home warranty makes it much easier to plan financially for unexpected repairs and replacements. Moving into a new house is always financially stressful – you’ve paid closing costs, acquired homeowner’s insurance, paid for movers, and maybe even bought new furniture and appliances. Be prepared for unexpected breakdowns and repairs. Help protect your budget and your new home with a home warranty from American Home Shield.