Post-Closing Surprises: 92% of Homebuyers Experience Problems with their Home in First Year

We wanted to know what the most common post-closing “surprises” were– and how much they were costing homeowners.

We wanted to know what the most common post-closing “surprises” were– and how much they were costing homeowners.

The excitement of buying a home is huge: months if not years of searching are finally coming to a close. A new opportunity awaits– but as most homeowners can tell you, homes can be full of surprises, even after the most thorough inspection.

In September 2024, American Home Shield surveyed 1,004 homeowners ages 19-78 nationwide on all the quirks, issues, and problems they encountered during their first year of homeownership — and whether they think the previous owners did a good job maintaining their homes.

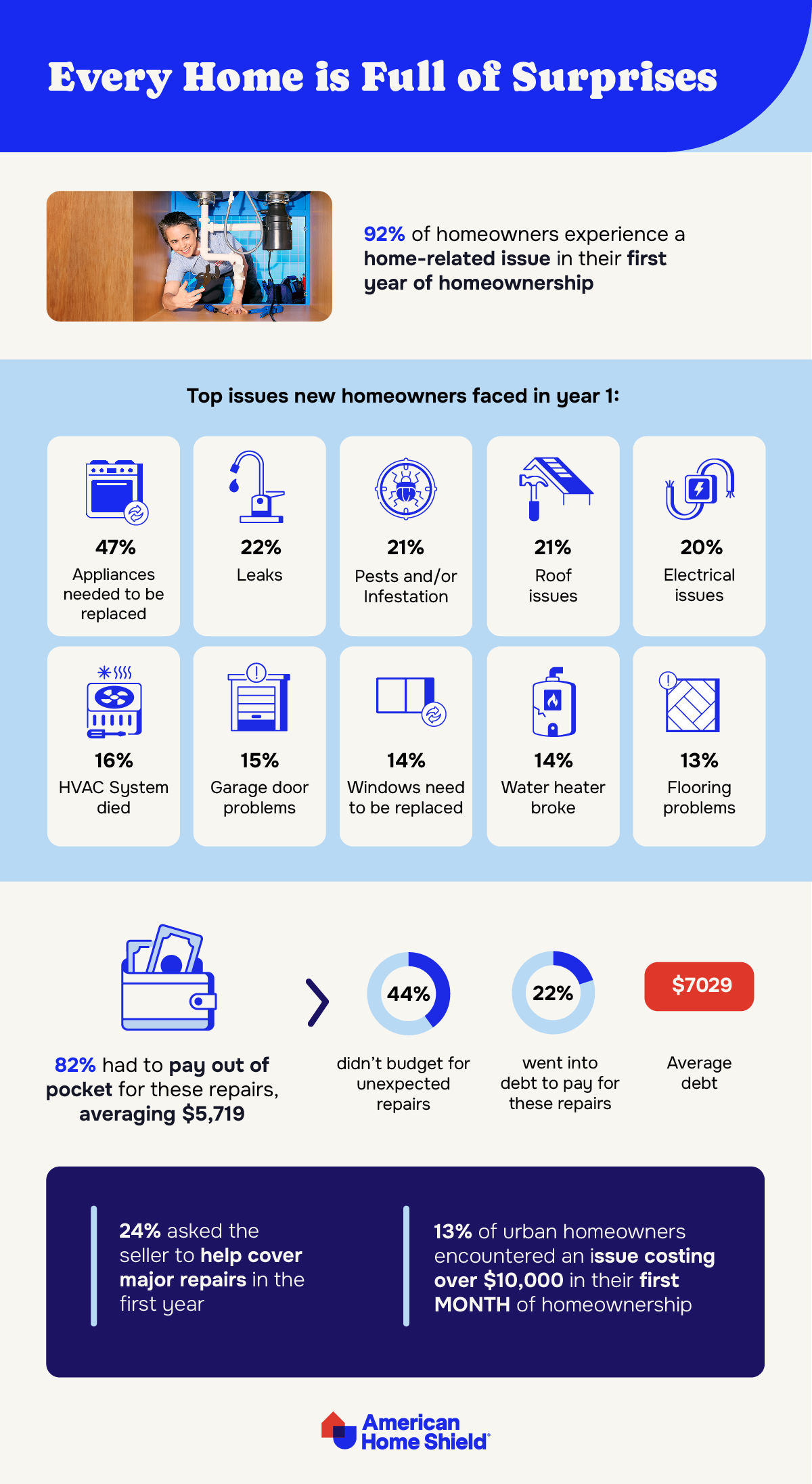

There’s no getting around it: chances are, as a new homeowner, you will encounter an unexpected issue in your first year of homeownership. Most homeowners (92%) experienced at least one issue in their first year, and some, more than one.

By far the most common problem of new homeownership is needing to replace appliances, which 47% of homeowners marked as an issue encountered in their first year. Leaks, infestations, roof issues, and electrical problems affected about 1 in 5 homeowners as well. Sixteen percent had the unfortunate pleasure of their HVAC system dying, which can mean serious discomfort and a high price tag for repair/replacement, especially in the summer. Other top issues include garage door problems, replacing windows, broken water heaters, and flooring problems.

Over 4 in 5 new homeowners, freshly off paying a large sum to close on their house, had to pay out of pocket for the above issues.

Nearly 1 in 4 tried to cut their losses by asking the seller to cover repairs in their first year. Typically, this means asking for either a lower selling price to defray costs or making allowances for repairs as part of the sale.

Among new homeowners that bought homes in cities, some were especially unlucky: over 1 in 10 encountered an issue costing over $10,000 in their first month of homeownership!

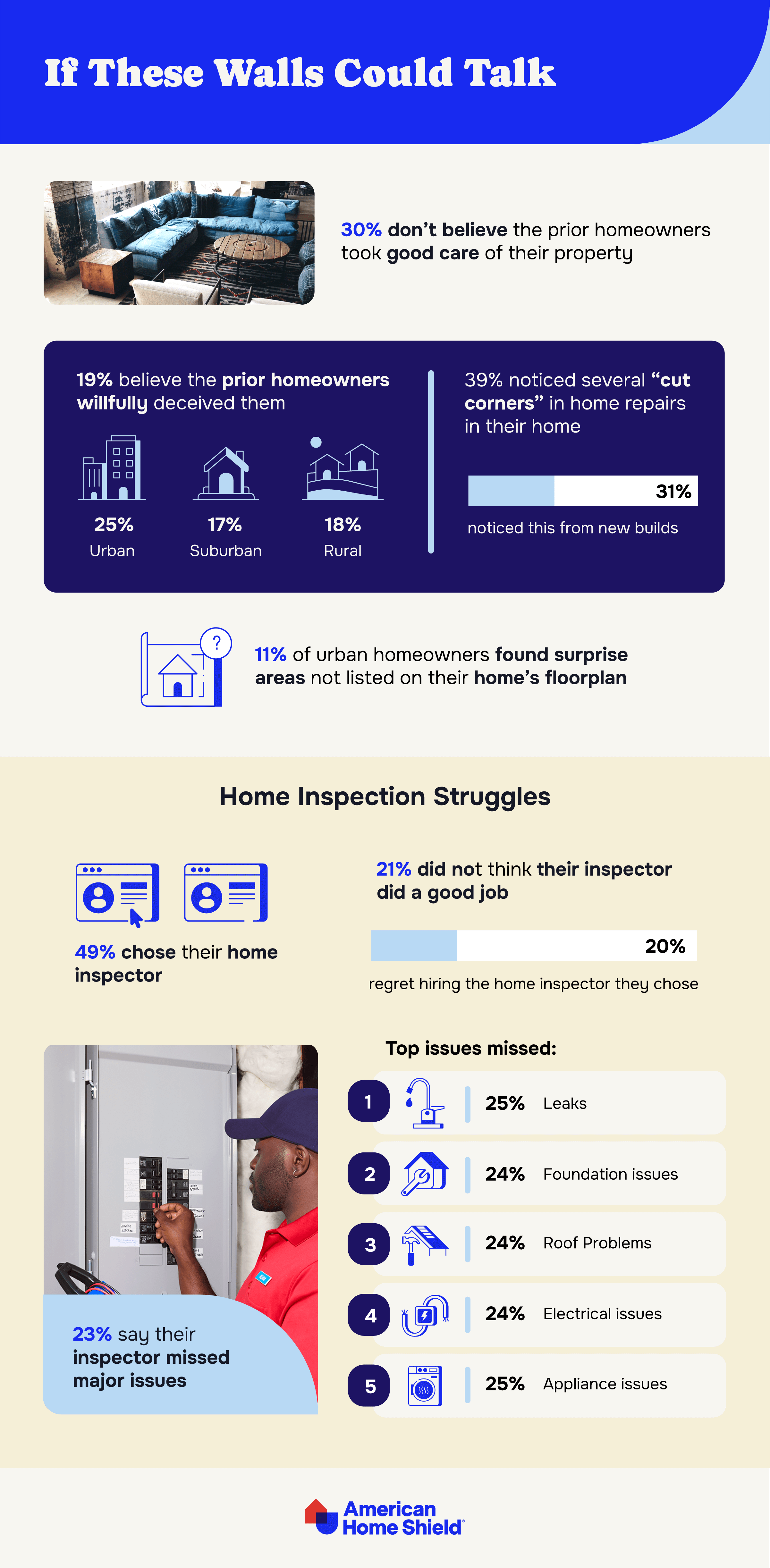

While some home-related problems are pure bad luck, some others might be the result of poor maintenance on the part of the prior homeowners. Except in the most obvious cases, many homes appear fine– until you discover something during inspection. Thirty percent of the new homeowners we surveyed don’t believe their sellers took good care of their homes.

Nearly 1 in 5 (19%) would go so far as to say that the prior homeowners willfully deceived them. When analyzed by location– urban, rural, and suburban areas– the numbers tell an interesting story: 25% of urban homeowners say the prior homeowners willfully deceived them about some aspect of their home, compared to 18% of rural and 17% of suburban homeowners.

Another common issue is finding “shortcuts” in prior repairs. Nearly 2 in 5 (39%) found this in their homes, including 31% of those who purchased a newly built home!

A less common but much more surprising occurrence is finding spaces in your new home that weren’t listed on the floor plan– whether it’s a crawl space or even a basement, this can be quite a shock! It’s more common for urban homeowners, apparently as 11% found an area of their home that wasn’t on the floor plan.

Many soon-to-be homeowners depend on house inspectors to find any issues in their homes before closing to ensure they’re not on the hook for major repairs. Overall, just about half (49%) of homeowners chose their home inspector. No one is perfect at their job, but some inspectors are better than others: over 1 in 5 surveyed didn’t think their home inspector did a good job, and 20% regret hiring them.

Nearly 1 in 4 (23%) said their inspector missed major issues. The most missed issues include leaks, foundation issues, roof problems, electrical issues, and appliance issues.

Looking for a home inspector? Increase your chances of finding a quality home inspector by consulting your real estate agent, asking friends and/or family, and doing your due diligence and reading reviews of any inspector before engaging their services.

Thinking about coverage?

Security for your home. Protection for your budget.

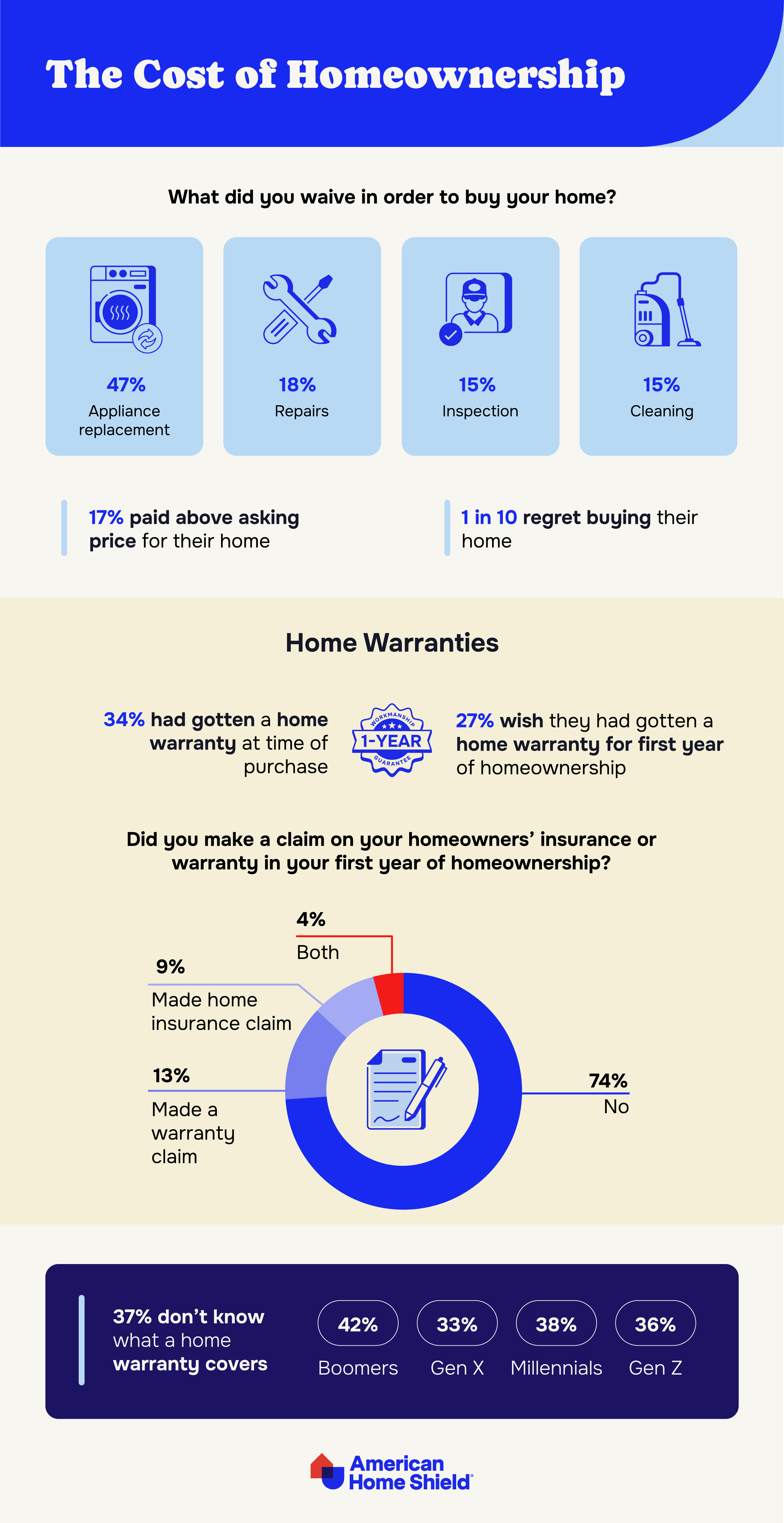

The 2024 housing market has been challenging for buyers; some would-be homeowners were willing to make sacrifices to get those keys in hand. Nearly 1 in 5 (18%) waived appliance replacements or general repairs to buy their home, while 15% took the route of waiving their inspection to purchase. Additionally, 17% paid above the asking price for their homes.

While most buyers are happy with their new homes, it doesn’t always work out: 1 in 10 said they regret their purchase.

One way to mitigate the potentially steep costs of home repairs is through a home warranty. A home warranty doesn’t function as an emergency repair service, but it can cover the repair or replacement of major home systems and appliances like your HVAC, plumbing, electrical, refrigerator, washer, dryer, and more.. About 1 in 3 homeowners surveyed had gotten a home warranty at the time they purchased their home; 27%, meanwhile, wish they had done so for their first year of home ownership.

Over 1 in 10 made a claim on their home warranty in their first year of ownership, while just 9% made claims on their homeowners insurance. Sadly, 37% of the homeowners we surveyed don’t know what a home warranty covers; this expands to 42% for Baby Boomers.

A home warranty is a yearly protection plan for your home’s systems and appliances. Like most homeowners, you may find yourself asking, “what does a home warranty cover?” Your home warranty can cover the things in your home that you and your family rely on most, like the refrigerator, dishwasher, heating and AC systems, water heater, and other home systems and appliances.

For reference, homeowners insurance protects the structure and contents of your home from specific types of damage; for example, most insurance will cover fire, vandalism, and theft. This insurance also provides liability protection for any injuries that might occur on your property. Many mortgage lenders require homeowners insurance. Instead, home warranties can cover repairing and replacing home systems and appliances. The combination of the two will provide you the most protection, coverage, and peace of mind!

Homeownership will always have its ups and downs– as well as its fair share of surprises. The structures that house us and keep us safe age and need repair–just like we do. While major issues can be costly and daunting, it’s comforting to know that you’re not alone, and that every issue can and will be addressed.

The data in this report comes from a survey:

In September 2024 American Home Shield surveyed 1,004 homeowners across the nation about their current homes and issues they encountered in their first year of homeownership. 50% were men, 49% women, and the remaining 1% were either nonbinary or chose not to disclose. Ages ranged from 19-78 with an average age of 45.

Fair Use

When using this data and research, please attribute by linking to this study and citing AHS.com.

Have a plan for your home when things don't go according to plan

Shop Home Warranties