A home warranty so protective, it feels like magic.

There’s a future where surprise repairs don’t stress you out. Let’s make it happen.

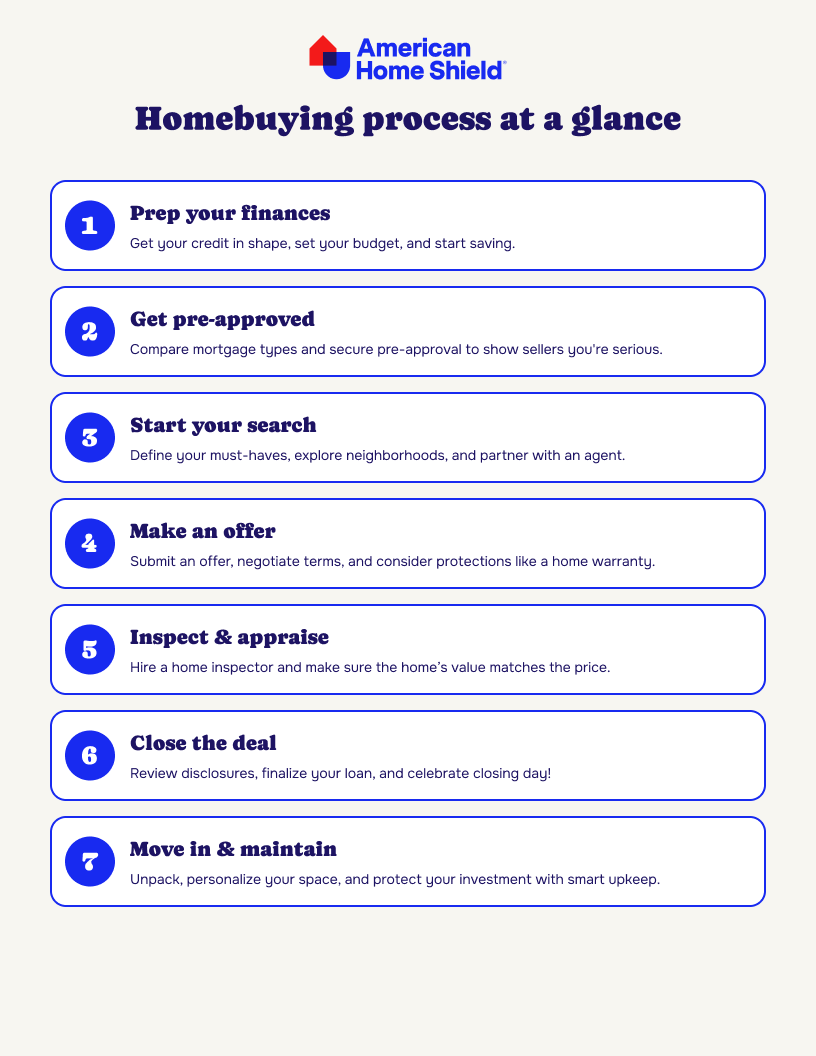

So, you’re ready to buy a home for the first time. This is a big, expensive deal and there’s a lot to be worried about—but equally as much to be excited about. We’re here to supply all the first-time homebuyer information necessary to help you tackle this next step with confidence.

Buying a home for the first time is no walk in the park. Between navigating hidden costs, mortgage approvals, and the idea that you’re beginning a whole new phase of your life, there’s a lot to juggle. Together, we’ll explore some of our top first-time homebuyer tips, how to avoid common homebuyer mistakes, and avoid any feelings of homeownership remorse.

While you may be looking forward to scrolling through listings and touring open houses, the foundation of our first-time homebuyer guide is to take stock of your finances.

Start by understanding where you stand. Pull your credit report—you’re entitled to one free report per year from each of the three major bureaus: Equifax, Experian, and Transunion; you can do this online by visiting AnnualCreditReport.com.

Calculate your debt-to-income (DTI) ratio, a comparison of how much you owe each month to how much you earn. You can do this by adding up your monthly bills and dividing the total by your gross monthly income, resulting in your DTI percentage.

Finally, take inventory of your savings. This will give you a clear idea of what you can afford and what still needs work.

What do you need to buy a house for the first time? A realistic budget. Look at your monthly income, expenses, and how much you can reasonably afford for a mortgage without stretching yourself too thin. Remember to include property taxes, homeowners insurance, and potential HOA fees.

An online mortgage calculator is a valuable tool that can help you see how different home prices, down payments, and interest rates impact your monthly payment.

Budget your protection with a home warranty

Most lenders recommend saving at least 20% of the home’s purchase price for a down payment to avoid private mortgage insurance, but don’t worry if you can’t swing that much. Many first-time buyers put down as little as 5%.1 The key is to start early and be consistent.

You may also want to create a separate savings account just for your down payment so it doesn’t get mixed in with everyday spending. This is one of those first-time homebuyer information gems people often overlook: even a modest down payment can open doors, especially with the right loan.

Additional reading:

Support for every step of the homebuying process

Download our free first-time homebuyer worksheet today to help your organize your journey.

If you’re wondering how being a first-time home buyer works when it comes to financing, you’re not alone. Mortgages can seem like a maze, but we’re here to demystify them.

There are a few common mortgage options:

What do you need to buy a house for the first time? One of the first things is a solid pre-approval letter. Pre-approval is a lender’s written commitment stating how much they’re willing to loan you. Getting pre-approved shows sellers you’re serious and gives you a solid idea of your price range before you start house hunting.

When shopping for a lender, compare interest rates, fees, and customer reviews. Don’t be afraid to ask questions. After all, this is your future we’re talking about.

Additional reading:

How long does it take to get a mortgage approved?

Buying a house with student loan debt

Once your finances are in order and you’re pre-approved, the real fun begins: house hunting! This part of the first-time home buyer guide is all about narrowing down your wants and needs and making smart decisions that fit your budget and lifestyle.

Before you start scheduling tours, make a list of must-haves versus nice-to-haves. Do you need three bedrooms or just really want a guest room? Is a big backyard essential, or can you live with a patio?

In 2025, 42% of buyers buying a new home for the first time made the choice they did in order to avoid renovations or problems with plumbing or electricity. At the same time, 30% of buyers felt the biggest home characteristic they compromised on was price.**

There will always be compromises in any home search, so it’s important to think about what qualities are nonnegotiable for you, and for which you have a little bit of wiggle room.

School districts, commute times, nearby amenities, and even future development plans can all influence your decision. Spend time in neighborhoods you're considering.

More than half of surveyed homebuyers in 2025 made their neighborhood choice based on perceived quality of the neighborhood itself. Other top considerations included proximity to family and friends, the overall affordability of homes in that neighborhood, and convenience to their job.***

Visit a neighborhood at different times of day, talk to locals, and check crime and walkability scores online. Sometimes the perfect house is in a not-so-perfect location—and sometimes a slightly less perfect house in the right area ends up being the best fit.

A great agent makes a huge difference, especially for first-time buyers. Look for someone familiar with your local market who can serve as your first home buying guide. They should be able to answer questions clearly, advocate for your interests, and explain all the steps without jargon.

With your wish list and agent in hand, it's time to hit the open houses. Take notes, snap photos, and ask questions. Revisit your initial checklist to assess the homes: Are you staying within budget? Does the home meet your non-negotiables? Is it in a location that fits your lifestyle? House hunting can feel overwhelming, but it's also where the process gets exciting and real.

Flexibility is key in a competitive market. Your dream home might have outdated tile or a smaller yard than you imagined—but if it’s structurally sound, in a great neighborhood, and within budget, it might be worth a closer look.

The perfect house doesn’t always look perfect at first. Be open to cosmetic upgrades and creative solutions and lean on your agent to help you see the potential in each space.

Additional reading:

10 Best cities to raise a family

Top 10 historic neighborhoods in the US

Which US cities and states have the most smart home listings?

The US cities and states with the most pet-friendly homes

The 6 best real estate apps and sites for house hunting

If you’ve found “the one,” it’s time to make a move. Our first-time homebuyer information about making an offer and negotiating terms is here to save you stress and money.

A big question we hear is: how does being a first-time home buyer work when it comes to offers? Basically, your agent will help you draft a formal offer, which includes the purchase price, contingencies (like inspection or financing), and timeline. If the seller accepts—congrats! If they counter, you’ll have a chance to negotiate.

What do you need to buy a house for the first time besides money? More than anything, confidence, and a willingness to walk away if it’s not right.

You can negotiate more than just the price. You might ask the seller to cover closing costs, include appliances or furniture, or even throw in a home warranty plan. A home warranty can help cover the cost of repairing or replacing major systems and appliances that break down due to normal wear and tear. If you’re unsure, talk to your agent to help determine what’s reasonable to ask for based on the local market.

Earnest money is a good-faith deposit that shows the seller you're serious. It's usually around 1–3% of the purchase price and is submitted with your offer. If the sale goes through, that money gets applied toward your closing costs or down payment.

But be aware: If you back out of the deal for a reason not covered by a contingency, you could lose that deposit.

Once your offer is accepted, there are a couple of important checkpoints to clear before you break out the moving boxes. This part of the first-time home buyer guide is all about learning how to protect your investment before you sign on the dotted line.

The home inspector gives you a professional assessment of the property’s condition. A licensed inspector will look at the structure, roof, plumbing, electrical systems, HVAC, and more. If significant home issues come up, you may have the option to negotiate repairs, ask for seller credits, or walk away altogether.

An important piece of first-time homebuyer information: be there for the inspection if you can. It’s a great opportunity to learn about the house you’re buying and ask questions in real time.

While the inspection is for your benefit, the appraisal is for the lender’s. It determines the fair market value of the home to make sure the loan amount aligns with the home’s worth.

If the appraisal comes in at or above the purchase price, great, you’re good to go. But if it comes in low, your lender may reduce the loan amount, which could mean renegotiating with the seller, covering the difference yourself, or potentially walking away.

If the inspection or appraisal reveals major red flags—like structural damage, outdated wiring, or mold—you’ll need to weigh your options. Sometimes sellers are open to fixing problems or lowering the price. Other times, the issues might be too big to take on. This is a huge investment, and it's okay to say no if things don’t feel right.

Additional reading:

Is a home inspection required?

Common problems in recently purchased homes statistics

What to consider before buying a flipped house

Everything you need to know about buying a fixer-upper home

You’re in the home stretch! Once inspections and appraisals are squared away, it’s time to tie up the final details and prepare for that sweet moment when you finally get the keys.

At least three business days before closing, you’ll receive a closing disclosure. This document breaks down your loan terms, interest rate, monthly payment, and all closing costs. Review it carefully and compare it to your original loan estimate. If something doesn’t look right, speak up.

By now, your lender will be working behind the scenes to get your loan “cleared to close.” This involves verifying income and employment, reviewing final documents, and ensuring everything lines up.

Your job? Stay responsive, avoid big financial moves (like opening new credit cards or changing jobs), and keep your paperwork handy just in case something last-minute pops up.

On closing day, you’ll meet with your agent, lender, and possibly an attorney or closing agent to sign a (large) stack of documents. Once everything’s signed, sealed, and delivered, you’ll get the keys to your new home.

It’s official: You’re a homeowner!

Now that the keys are in your hand and the paperwork is behind you, it’s time to shift gears from buying to owning. This final section of our first-time homebuyer guide will help you settle in and set yourself up for long-term success.

If your seller included a home warranty as part of the deal—great! If not, now is the perfect time to get one. A home warranty can help protect your budget by covering the repair or replacement of major systems and appliances that break down from normal wear and tear.

What do you need more than anything when buying a house for the first time? A home warranty can truly revolutionize the experience of owning your own home for the first time. When you have a home warranty, you don’t need to be an expert in HVAC, plumbing, or electrical to feel confident about your newfound homeownership. It provides true peace of mind as you get to know the ins and outs of your home.

And when you buy an American Shield home warranty plan, you get more than just protection for your home’s systems and appliances. With select plans, enjoy the AHS video chat feature that allows you to call home repair Experts in real time to assess or fix covered problems. Enjoy clear answers, at no extra cost, without the unnecessary money or hassle of calling an in-person Pro to your home. It’s the perfect companion for a first-time homebuyer unsure about how serious a potential repair might be.

There’s a future where surprise repairs don’t stress you out. Let’s make it happen.

Plan your move strategically: label boxes clearly, set up utilities ahead of time, and change your address with the postal service, bank, and any subscription services. Keep important documents—like your mortgage paperwork and warranty info—in a safe, accessible place.

Also, take time to meet your neighbors! It’s a small step that can go a long way in helping you feel truly at home.

Your next chapter awaits. Get our free moving into a new house checklist to get started.

Regular maintenance keeps your home running smoothly and helps you avoid expensive surprises. Clean gutters, service your HVAC, check smoke detectors, and inspect your roof and foundation seasonally.

A first-time homebuyer should know how general maintenance works, especially because it plays an important role in increasing the value of your home and extending the life of your systems and appliances.

Each mortgage payment you make builds equity—your financial stake in the home. Over time, you can use that equity for renovations, big purchases, or even to buy your next home.

Think of your house as both a home and an investment. Take good care of it, make smart upgrades when you can, and stay on top of the market.