Whether you are buying a new house or renovating the property you’ve had for years, it’s important to have home warranty coverage to protect your hard-earned dollars. Matt Blashaw knows that, too. A home improvement and renovation expert and spokesperson for American Home Shield®, Blashaw recommends AHS® home warrantys to clients to ensure that the major parts of their hardworking home systems and appliances are covered when they inevitably break down.

Video Transcription

VO: For many Americans, their homes are their most valuable asset, and routine upkeep can help protect that investment. Protecting it from things like theft and fire makes sense. That’s why you have insurance. But what about planning for the inevitable system and appliance breakdowns due to everyday use?

Designing spaces caught up with Matt Blashaw to learn more about American Home Shield.

Matt Blashaw: As homeowners we have lots of items that we use every day. So, it’s inevitable that something is going to break down along the way. I often recommend to my clients that they consider a home warranty. It can help relieve the stress and anxiety of unexpected breakdowns.

VO: A home warranty is not the same as homeowners insurance. In fact, you are 25* times more likely to use your home warranty than your homeowner’s insurance. An American Home Shield home warranty can help protect your budget from expensive home breakdowns and offers you access to a nationwide network of contractors (Pros), so you don’t have to search for one yourself.

Matt Blashaw: American Home Shield is a home warranty provider that helps cover the cost when parts of your home systems and appliances wear out, like your air conditioner, dishwasher, or plumbing. With 2 million members, American Home Shield is the most preferred home warranty in the nation. They have a nationwide network of contractors (Pros) to serve their 2 million members, and they’ve been helping take the stress and hassle out of homeownership for 50+ years.

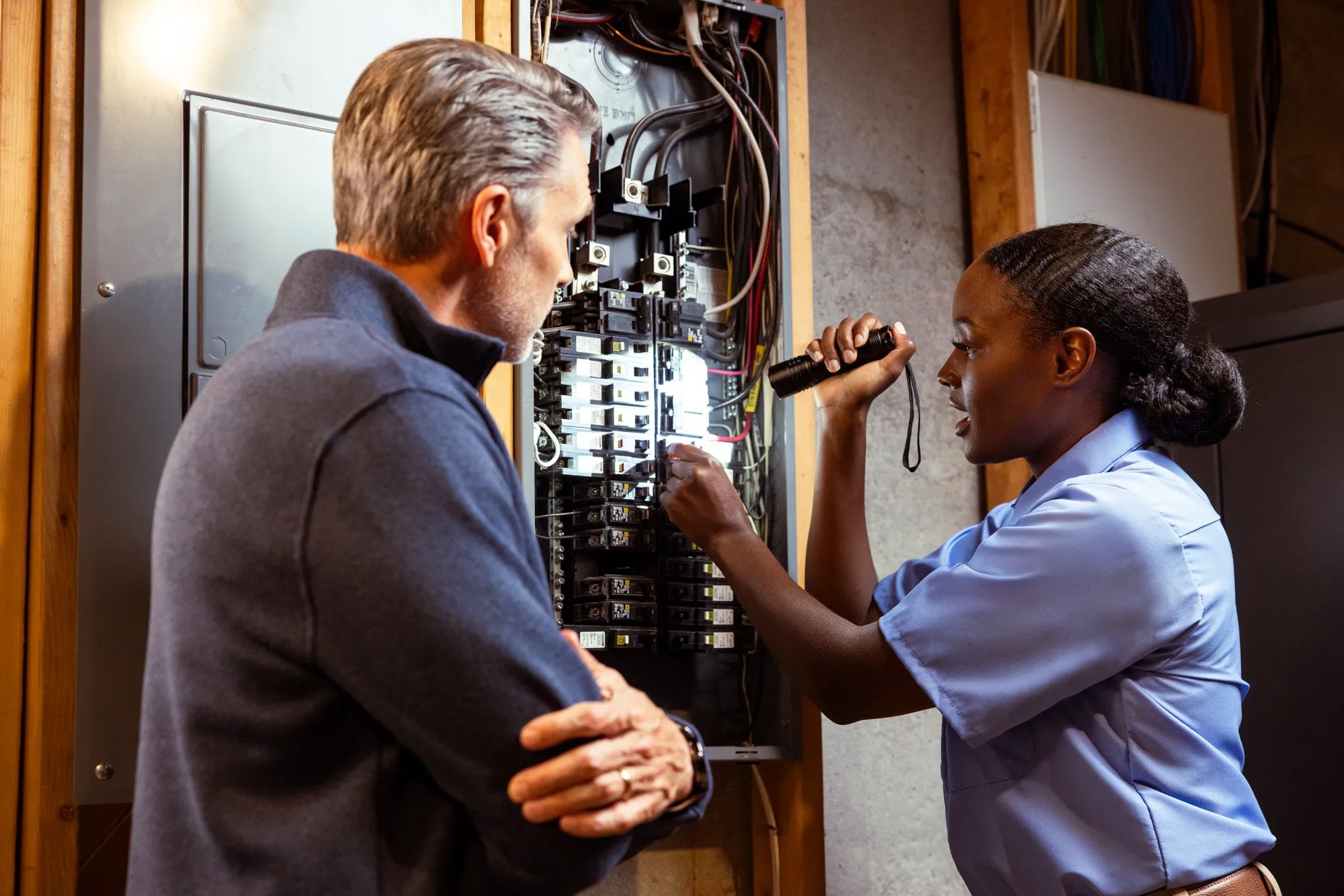

The good news is is American Home Shield covers the parts of up to 23* home appliances and systems, including heating and air conditioning units, laundry and kitchen appliances, electrical systems, and plumbing systems. And, if they can’t repair your covered item, they’ll replace it.

They also offer additional coverage for roof leak repairs, electronics, in-ground pools, and hot tubs. American Home Shield knows that every home and homeowner’s needs are different. Which is why they offer plans featuring flexible options and pricing to perfectly fit your needs and budget.

VO: American Home Shield has coverage to help protect the parts of up to 23 home systems and appliances from normal wear and tear. They cover these items regardless of age, and no maintenance records or inspections are required. Homeowner Tara is a mom with an older home. She decided to find a home warranty that was just right for her.

Matt Blashaw: How long have you been in the house?

Tara: Almost 20.

Matt Blashaw: Twenty, okay. So, why is it important to have a home warranty?

Tara: The last thing you want to worry about is something breaking down in your home. So, when it does, you don't have to worry. And, they will take care of it. They’ll send out a qualified professional and it will be repaired and you're on your way and it's back up and running again.