Why You Need a Home Warranty and Homeowners Insurance

If you own a home, you probably have home insurance. In fact, it’s likely that you’re required to have it. But do you have a home warranty?

If you own a home, you probably have home insurance. In fact, it’s likely that you’re required to have it. But do you have a home warranty?

If you own a home, you probably have home insurance. In fact, it’s likely that you’re required to have it. But do you have a home warranty? You may be asking yourself what is a home warranty and do you even need one? The answer is yes!

A home warranty, like home insurance, is a crucial piece of protection for any homeowner. And it’s when you are covered by a home warranty and insurance that you have the most security and best coverage any homeowner can hope for. Below we’ll go into greater detail about each type of policy and why, most importantly, it’s crucial to have both.

Homeowner’s Insurance: Or Why You Need to Worry About What MIGHT Happen.

Theft, storms, fires, natural disasters – will any of these things definitely happen while you own a house?

For many people, probably not. But they might happen and that’s when you’ll be glad you have homeowner’s insurance. Of course, most people are actually required to have homeowner’s insurance. You’ll generally be required to have one before a bank will give you a mortgage on a home.

A home insurance policy covers four primary areas: the interior and exterior of a house, personal property in the case of theft, loss or damage, and general liability if someone is injured on your property. Policies are renewed yearly and have an average annual cost between $300 and $1000. Policies offer a deductible (the amount you're responsible for on a claim) and only after it’s been met do they take care of the additional costs.

Thinking about coverage?

Sounds like a plan. Find the warranty that fits you best.

Home Warranty: Or Why You’ll No Longer Need to Worry About What WILL Happen.

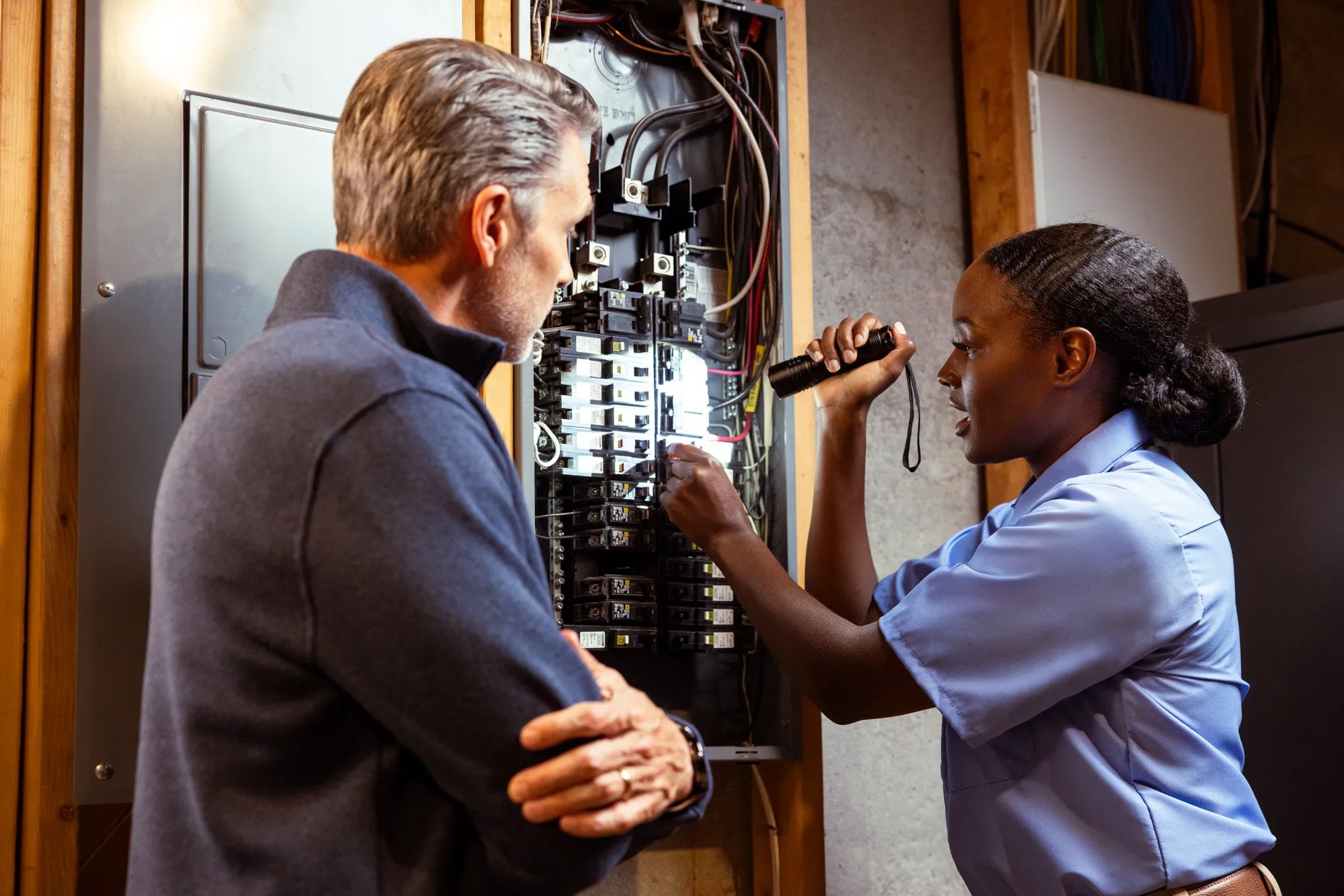

A home warranty is a service plan that repairs and replaces covered home systems and appliances that fail due to both age and standard wear and tear. HVAC, electrical, kitchen appliances, plumbing, and washer/dryer may all be covered under a home warranty. For example, an AHS® home warranty covers up to 23 of your home’s major systems and appliances. Unlike home insurance, home warranties are not mandatory and are typically purchased as a 12-month contract term. They usually don’t require a deductible, and you’re instead charged a moderate service fee.

In practice, a home warranty works like this: If your refrigerator stops working, a qualified Pro will be assigned to come to your home and diagnose the issue. If the breakdown is covered, the Pro will repair your refrigerator. If it can't be repaired, we'll replace it, subject to your coverage details. Given the cost of a repair or potential replacement, a home warranty can save you money.

Homeowner’s Insurance and Home Warranties: Or Why It’s Time to Double Down on Protection For Your Home.

The best way to think about homeowner’s insurance and a home warranty is that the two different policies work together to give you maximum protection. Say you have a leaky pipe, depending on the nature of the leak it may be covered by one policy but not the other. The home warranty would cover the repair of the pipe but not the damage caused by the leak. On the other hand, homeowner’s insurance would cover the damage of a major leak but not necessarily the repair of the pipe.

With both policies you’re covered on the repair and the damage caused by the leak. Home insurance protects you from the things that might happen. And with a home warranty plan, you no longer have to worry about the things that will happen. That’s coverage everyone can feel comfortable with.

Next > What's the Difference: Homeowners Insurance vs. Home Warranty

Explore our protection plans for your home's most important systems.

AHS assumes no responsibility, and specifically disclaims all liability, for your use of any and all information contained herein.

Have a plan for your home when things don't go according to plan

Shop Home Warranties