We’ll keep it real.

With our home warranty plans from AHS, you’ll get protection for your home and your budget's peace of mind.

Buying a home is never simple; between finding the right home and navigating the buying process and legal steps along the way, many first-time homebuyers can feel overwhelmed, confused, or lost as they navigate paperwork, inspections, and a new set of vocabulary. A home is one of the biggest investments the average American can make, and costs do not stop at the purchase price. From repairs and maintenance to decisions like whether to purchase a home warranty, homeowners often wish they had a clearer picture before they signed and initialed the dotted line(s).

In March 2025, we surveyed 1,001 homeowners about their first time buying a home, including top regrets as well as their budgets for associated costs like furnishing and repairs. Respondents were 50% men, 50% women, and ages ranged from 18-75 with an average age of 46. In terms of real estate environment, among respondents, 57% live in suburbs, 22% in cities, and 21% in rural areas.

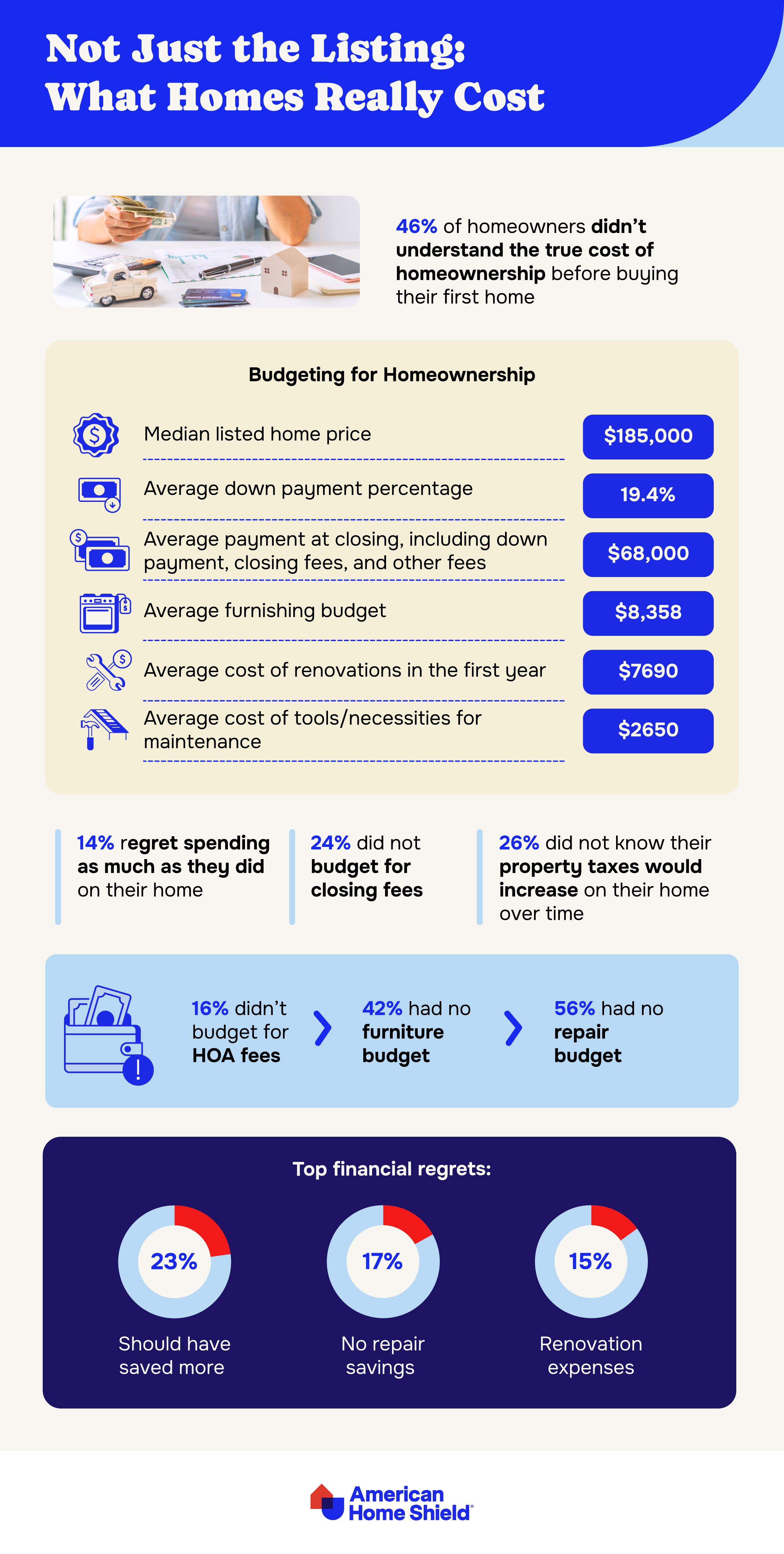

As any homeowner can tell you, the cost of homeownership goes well beyond the listed price: there’s taxes, closing fees, inspection fees, negotiations, down payments, mortgage rates, and a number of dizzying terms and costs that come to light as one moves through the process. When we asked the homeowners about their first experience buying a home, 46% said they didn’t understand the true cost of homeownership before purchasing.

When asked about first home expenses, the numbers showed a great deal of spending towards furnishing and renovations in addition to down payments:

Surveying homeowners about their first homes can mean their home was bought yesterday or 20 years ago.

Adding up down payment, furnishing, renovations, and tools purchased, the first year of homeownership can cost $86,698 – and many didn’t budget accordingly. Over 1 in 10 (14%) regret spending as much as they did on their home, and nearly 1 in 4 didn’t budget for closing fees.

Furthermore, 26% didn’t realize their property taxes would fluctuate and likely increase over time; another 16% didn’t budget for HOA fees. Over 2 in 5 had no furnishing budget, and 56% had no budget for repairs that often pop up in the first year.

Additional financial regrets for these homeowners include wishing they had saved more (23%), no savings for repairs (17%), and renovation expenses (15%).

Thinking about coverage?

Security for your home. Protection for your budget.

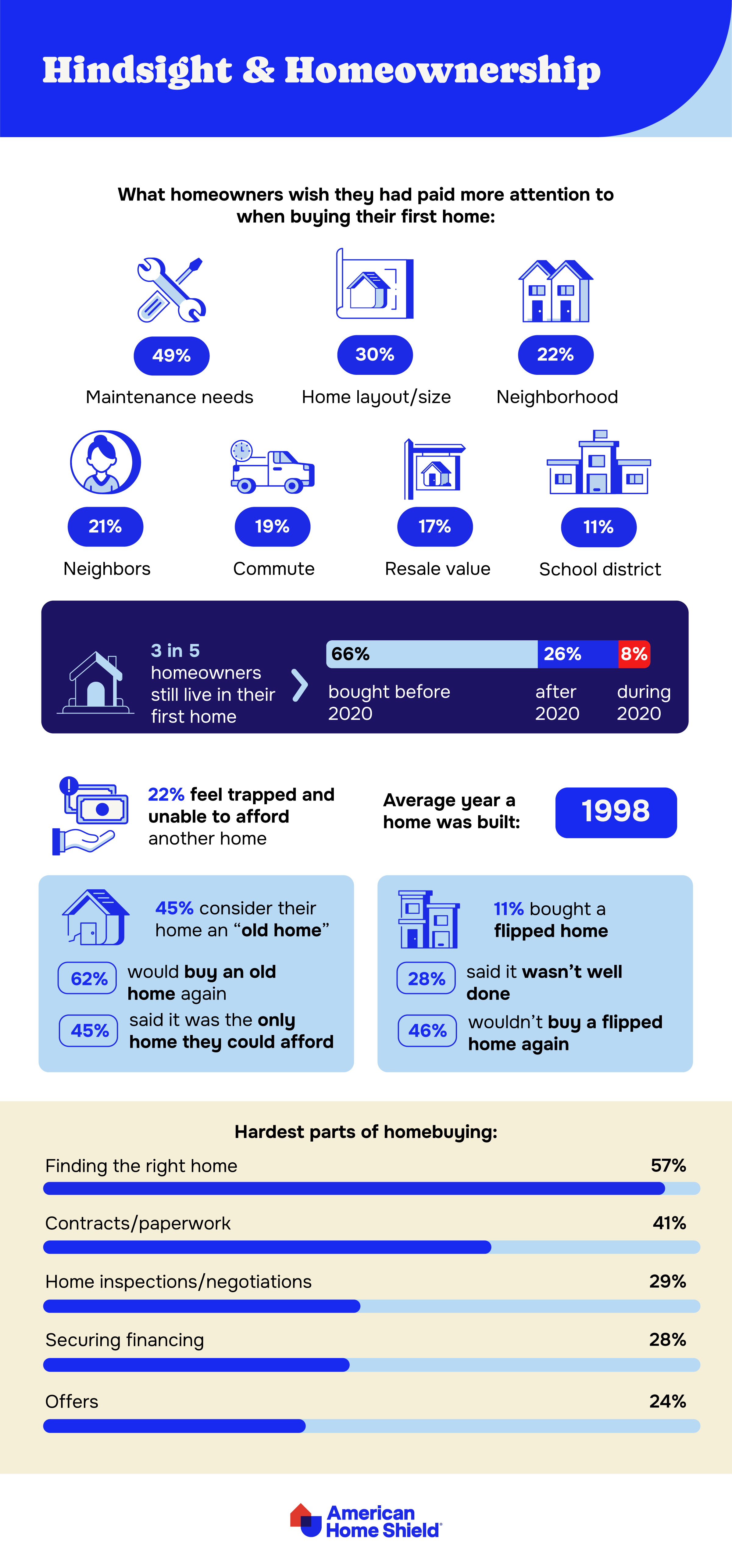

Besides the home itself, there’s many variables to consider when buying a home: neighborhood, neighbors, school districts, taxes, and more. What do the homeowners we surveyed wish they had paid more attention to before choosing the home they did?

Nearly half of respondent homeowners said they wished they had considered maintenance needs more before purchasing. After that, home layout (30%), the neighborhood (22%), neighbors (21%), and the commute (19%) round out the top five hindsight observations for homeowners.

While we asked specifically about first-time homebuying experience, it turns out that 3 in 5 homeowners surveyed still live in the first home they purchased. Two-thirds of them purchased their homes before 2020, while roughly 1 in 4 purchased after. A courageous 8% represent the COVID-19 class of homeowners, having purchased in 2020 itself.

Interestingly, 22% of current homeowners we surveyed experience buyer’s remorse, feeling trapped in their homes and unable to afford another, different home.

When it comes to types of homes, many of our respondents purchased old homes and flipped homes. While 45% of homeowners would characterize their homes as ‘old,’ most like them: 62% of old home owners would buy their old home again, even though nearly half (45%) said it was the only type of home they could afford.

Just over 1 in 10 bought a flipped home, or a home purchased and renovated quickly to turn a profit in real estate sales. Flipped homes seem to have had less success: 46% said they wouldn’t buy a flipped home again, and 28% said that the flip was poorly executed.

We also polled the homeowners on what they thought were the hardest parts of buying a home, and unsurprisingly, 57% said that finding the right home was the hardest part. With so many variables to consider, it can be overwhelming! Contracts and paperwork (41%), inspections and negotiations (29%), securing financing (28%), and bidding wars (24%) rounded out the top five.

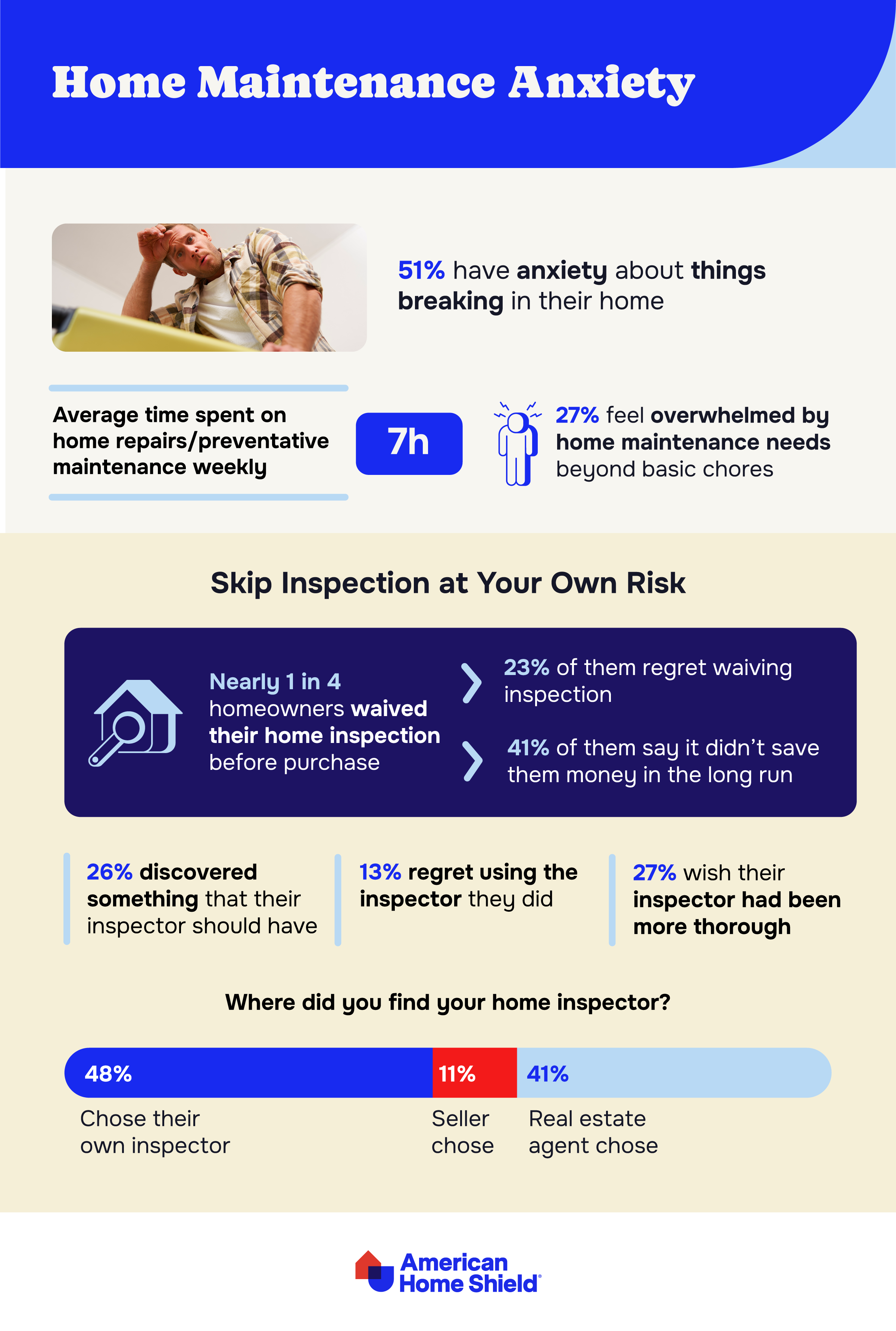

One overlooked side effect of home ownership is the anxiety of repair responsibility: 51% confess to having anxiety about things breaking in their homes.

The homeowners spend an average of 7 hours weekly on home repairs and preventative maintenance; for over 1 in 4 (27%), this is overwhelming.

When navigating the home-buying process, sometimes prospective buyers consider waiving home inspection as a way to entice sellers to choose them; this is risky, as it then delays detection of potential major issues in a home. Of those we surveyed, nearly 1 in 4 homeowners waived their home inspection before purchase. Unfortunately, 23% regretted waiving their inspection, and 41% said it didn’t save them money in the long run.

Among all homeowners, over 1 in 4 ended up discovering something in their homes that their inspector should have found. Additionally, 13% even regret using the home inspector that they did, and 27% wish their inspector had been more thorough.

Where are homeowners finding their inspectors? Nearly half (48%) chose their own independent inspector, while 41% used the inspector their real estate agent selected. A further 11% used the inspector their seller chose.

While hindsight will always be 20/20, there’s a wealth of resources to help you navigate the home buying process, and for maintenance and repairs, American Home Shield can help you rest easier tonight knowing that you’ve got coverage for home systems and appliances. Learn more about what we cover and our membership plans here.

When using this data and research, please attribute by linking to this study and citing AHS.com.

With our home warranty plans from AHS, you’ll get protection for your home and your budget's peace of mind.

AHS assumes no responsibility, and specifically disclaims all liability, for your use of any and all information contained herein.

Have a plan for your home when things don't go according to plan

Shop Home Warranties