Save your paperwork.

Hang on to your purchase receipt and the manufacturer’s certification statement. Your installer or manufacturer will also give you a special 4-digit PIN or QM code that links your purchase to the credit.

There are a lot of potential benefits to upgrading your HVAC system: lower utility bills, increased comfort, and peace of mind, to name a few. But did you know one big incentive—up to thousands of dollars big—is only available for a limited time?

The Inflation Reduction Act (IRA), passed in 2022, offers tax credits for home upgrades to certain energy-efficient HVAC systems. Originally set to last until 2032, this tax incentive program will now end December 31, 2025. One important detail to keep in mind is that there’s a maximum amount of credit you can claim per year under this program, which applies to all eligible home improvements—not just HVAC upgrades.

Although it’s clear that the landscape is changing, you may still be wondering: why upgrade now?

The truth is, there’s no time like the present to make HVAC energy-efficiency upgrades. Not only is the window closing to claim the tax credits, but there's a chance prices or availability for HVAC installation may rise as the 2025 deadline approaches.

Besides the potential tax credits, there are many benefits to upgrading to an energy-efficient HVAC system. These systems can help:

If you’ve been thinking about upgrading your HVAC system, now’s the time. You could save up to $3,200 — but only if you act before the deadline. Just keep in mind that this amount is the maximum available across certain home improvement projects. For example, if you’ve already claimed part of the credit for new windows or insulation, that would reduce how much you can apply toward your HVAC upgrade.

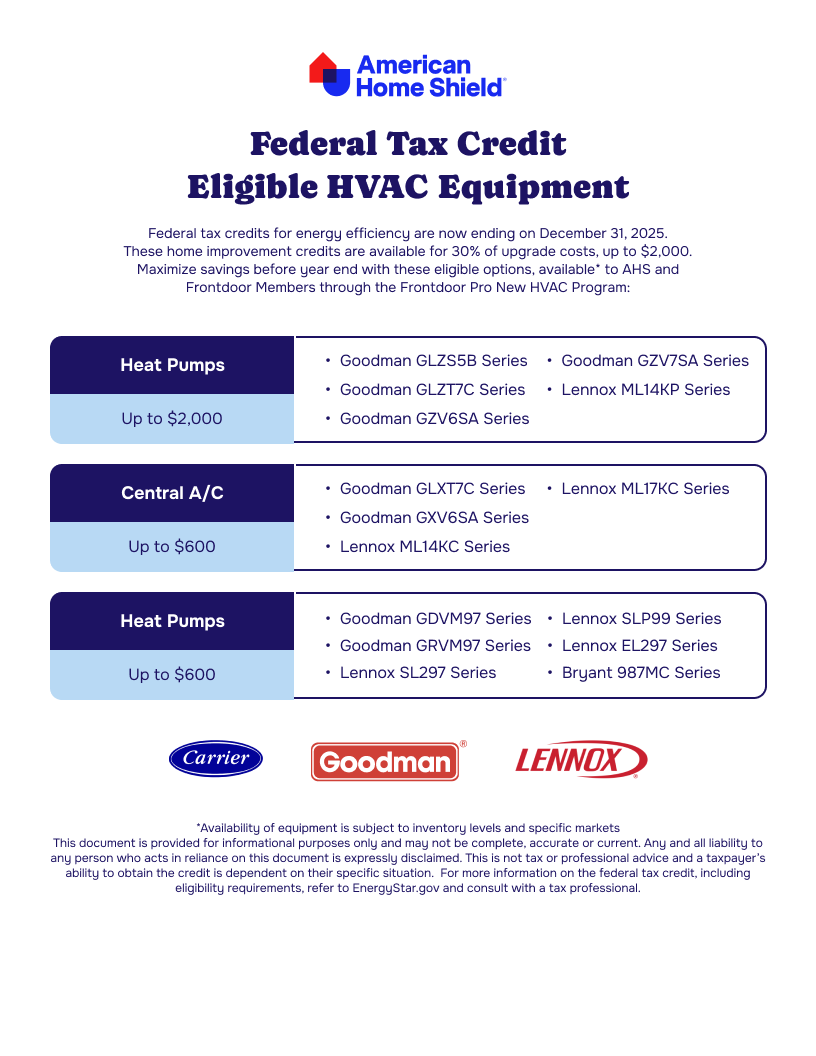

Not every HVAC system qualifies for the federal tax credit, so it’s important to know what makes the cut before you buy. Here’s a breakdown:

See what systems qualify

Check out this list of systems in our catalog that may qualify for federal tax incentives. Eligibility depends on product specifications and should be confirmed before purchase.

You can get more information from ENERGY STAR here.

Once you’ve chosen and installed an eligible system, claiming your tax credit is easier than you might think. For more information on tax credits for various systems, check out this video resource from EnergyStar.gov or consult your local tax professional.

Here are three notes to remember:*

Hang on to your purchase receipt and the manufacturer’s certification statement. Your installer or manufacturer will also give you a special 4-digit PIN or QM code that links your purchase to the credit.

This form is used to claim residential energy credits for your federal tax return. You’ll fill in details about your system and the total project cost.

Attach the completed form when you file for the tax year your installation was completed.

*This is not tax or professional advice and a taxpayer’s ability to obtain the credit is dependent on their specific situation. For more information on the federal tax credit, including eligibility requirements, refer to EnergyStar.gov and consult with a tax professional. The information provided in this article regarding the IRA tax-credit is for informational purposes only and may not be complete, accurate or current. Any and all liability to any person who acts in reliance on this document is expressly disclaimed.

Not sure where to start? American Home Shield is here to help. With more than 50 years in the home warranty business, we’re your trusted source for HVAC replacement and installation.

Through our New HVAC Program*, you can leverage our national buying power to potentially save thousands** off national retail pricing on a new HVAC system. That means on top of the IRA HVAC tax incentives, you could also save money on your new system when you’re an AHS member.

With the New HVAC Program, you get:

We help make the process hassle-free, so it’s easy to take advantage of available savings. Remember, you’re only eligible for these potential tax incentives if your qualified HVAC replacement is completed before December 31, 2025. Don’t wait—upgrade now and you could save thousands before time runs out.

*HVAC system upgrades are offered by Frontdoor Pro and performed by a Frontdoor Pro independent service contractor. For Frontdoor Pro license numbers, please visit http://pro.frontdoor.com/contractor-licenses.

**Pricing and amount of savings will vary based on location and equipment availability. Not available in all areas.